How can diamond make you rich?

3 min read

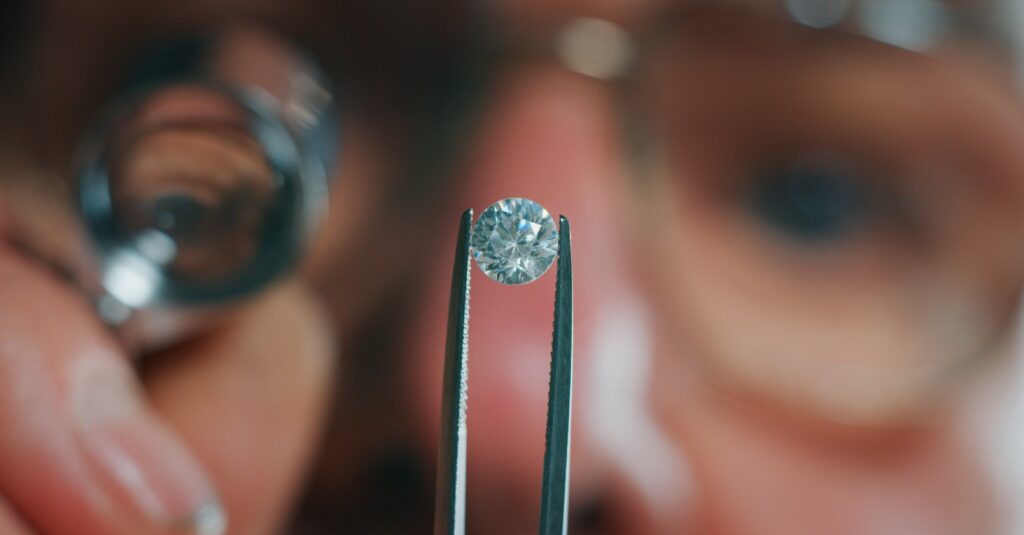

When you do diamond invest, you buy the physical stones to store them and sell them later. It involves locating and buying diamonds from a dealer. However, you don’t want to buy from the first retailer you come across. To find the best price, compare the prices of different merchants. When you shop online, you can compare prices from various merchants from the comfort of your home. If you want to gain market exposure but don’t want to own the stones, an investment with some industry relevance might be a good option. Stocks in a mining company, for example, might be an option.

The diamond is one of the maximum coveted gems for sentimental events and engagements and weddings, and it’s far cherished via way of means of many. It has additionally been for all time connected to the marketing and marketing industry. The toughest substance in the world is diamond. Each diamond mined or reduced is precise because of its difficult composition and shape. Despite the reality that diamond mining has been halted for some years, the market’s mining operations are all private.

How to invest in diamonds?

A diamond invest should be included in your alternative investment category, along with all that entails. This means that they should only take up a small portion of your wallet. The concept is quite simple. Investing in diamonds, as stated earlier, is based on the fact that diamonds are physical assets. As a result, you can buy them almost anywhere, even online. The following tips are general guidelines and how to invest in diamond tips and tricks if you want to.

- Knowing the basics will help you a lot

- Don’t forget to diversify your diamonds

- Always set a budget to buy diamond or to invest in diamond

- By using logic buy diamonds that are rare

- Try to buy diamonds at a cheap rate

- Be confident while diamond invest! Ask questions to others who have done it

- Comparing the prices of different diamonds

The risk that may involve while dealing with diamonds!

Diamonds may be an amazing investment; however, there are a few dangers involved. The maximum vast problems are pricing and evaluation. You can purchase them without problems with appearance up fees and buy standard-fee gold bars while buying gold. When it involves diamonds, the pricing is opaque. To clarify, you need to simplest purchase from professional sellers who have an amazing tune record.

Furthermore, you need to insist on a certificate that verifies the stone’s fee. Many establishments offer diamond certifications; however, GIA and AGS are of the best. Another difficulty is that diamonds are much less liquid than many different sorts of investments. It may be tough and time-ingesting to promote diamonds.

Conclusion

The 21st century has the best bet for making money from investments is gemstones and minerals. It is a safe market that guarantees liquidity when needed. Diamonds are also a wise investment for those looking to profit from them. Many misunderstandings, complexities and history plagued the diamond industry. There are certain myths about investing in diamonds in the 21st century that often prevent investors from taking advantage of a profitable opportunity.